Approval Rules 1/48 Sapphire

Since the Chase Sapphire Reserve relaunch, this is no longer a rule

Deep Dive into the 1/48 Sapphire Rule

With the announcement of the revamped Chase Sapphire Reserve card that launched in June, 2025, the Sapphire 1/48 Rule is no more. No longer can you wait 48 months to apply for a new Sapphire card and receive the bonus for it. Is this good or bad news? To be frank, we don't know yet. It's only been a little over 24 hours since the new Reserve was launched and the new terms became official, so we'll have to keep an eye on approvals and denials before making any firm declarations. The language is purposely vague and could be interpreted either way. Only Chase knows how strict or loose they are going to be when approving people for a new Sapphire card.

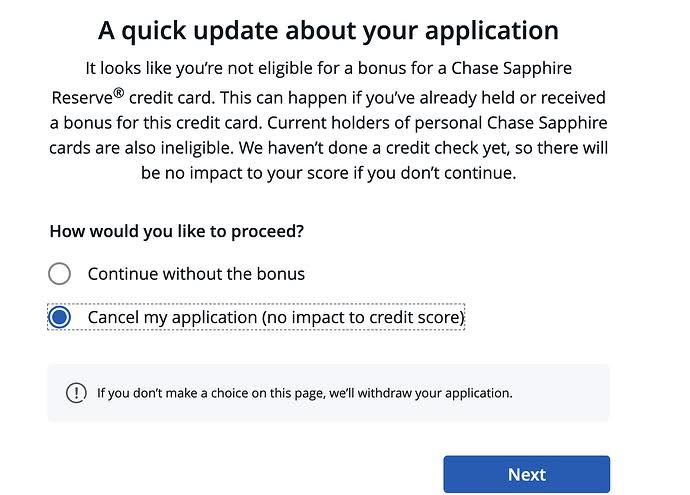

Chase has introduced a new popup similar to how American Express handles their application process. When you fill out an application, you may receive a popup that says you are ineligible for the bonus. It will then ask if you want to proceed with the application. If you do not want the card without the signup bonus, you can cancel your application before they do a credit check. The popup looks like this:

Here is the new language from the terms on the new Chase Sapphire Reserve card:

This credit card is unavailable to you if you currently have one open. The new cardmember bonus may not be available to you if you currently have any other personal Sapphire cards open, previously held this card or received a new cardmember bonus for this card. We may also consider the number of cards you have opened and closed, as well as other factors in determining your bonus eligibility.

There is a lot of ambiguity in the new language. Let's break it down for you though:

- This credit card is unavailable to you if you currently have one open: This is pretty clear. If you currently have a Chase Sapphire Reserve open, you won't be able to get a second. If you plan to apply for the updated version of the card, you will want to downgrade (preferable) or close your current Chase Sapphire Reserve.

- The new cardmember bonus may not be available to you if you currently have any other personal Sapphire cards open: Chase is being coy by using the language may not be available. They're leaving the door open for a Chase Sapphire Reserve approval even if you currently have a Chase Sapphire Preferred (or vice versa as the Preferred now has this same language). Data points so far show that you are more likely to be approved for the new Reserve card if you DO NOT have another Sapphire card open though.

- Previously held this card: Chase is covering their bases by saying they may deny you this card if you've already held this card before. This is insinuating there may be lifetime language similar to what American Express has (which in reality is 7-10 years), excluding anyone who has had this card at any time in the past. Data points so far point to that not being the case though, as we have seen people get approved for the updated Reserve while having it at some point in the past.

- Or received a new cardmember bonus for this card: This is similar to the last point. Chase is saying you may not be available to receive a new bonus if you have received a welcome offer on this card at any time in the past. May not is the key term here, though. There have already been reports of people being approved for the updated Reserve and being eligible for the signup bonus while receiving the signup bonus on this same card before

- We may also consider the number of cards you have opened or closed: Chase is saying they will look into your history when determining if you are available for this card. Credit card companies looking into your credit card history when applying for a new card is nothing new. When you are in this hobby, you will be opening and closing cards more often than the general population, so being denied a card for this reason is always a risk.

- As well as other factors in determining your bonus eligibility: This language just gives Chase a broad reason for denial. Other factors can literally mean anything.

At the time of this writing (June 24, 2025 - a little over 24 hours since the updated Chase Sapphire Reserve launched), all data points reflect the ambiguity of this language. We've seen people get approved and be eligible for the bonus while also receiving the signup bonus within the last two years on the Sapphire Reserve. We've seen people get denied while never having a Reserve.

Related Rules

How Does This Affect Your Credit Card Strategy?

You will most likely want to keep either the Chase Sapphire Reserve or Preferred in your wallet for the entirety of the 48 months, making this rule important to your overall strategy. The reason you’ll want a Sapphire card is they make it possible to transfer your miles to one of their 18 airline or hotel partners. This becomes even more important once you start applying for Chase Ink Business cards, which should be part of your long-term strategy.

Chase Ink Business cards don’t count against your 5/24 status, so they become an important part of your overall card plan. The business cards will allow you to collect more signup bonus points while not tripping the all important 5/24 rule. Out of the four Ink Business cards, the Chase Ink Business Preferred is the only one that allows you to transfer points to Chase’s partners. So any points you earn with the other Chase Ink business cards would have to be redeemed through their portal, which doesn’t offer the best value.

If you have one of the Chase Sapphire cards, you can transfer points earned from your business card to your Sapphire card, then transfer to any of their hotel or airline partners. This is where you really get the best value out of the hobby. Chase offers the best partners for high value redemption, which is why Chase Ultimate Rewards are the most popular in the hobby.

Once those 48 months have passed (and remember, it’s 48 months from when you received the bonus, not since you opened the card), you are eligible to apply for another Chase Sapphire card. First you must cancel or downgrade your current Sapphire card as you cannot hold a Sapphire card and get another one, no matter how much time has passed. We recommend downgrading to the Chase Freedom Unlimited or Chase Freedom Flex.

Importance of this Rule

* * * *

Even though this rule only affects two cards in the entire points and miles world, it’s still a very important one, particularly if you don’t have a partner you’re doing this hobby with. It’s crucial to know you can only get one of the Sapphire cards in a 48 month period. Because of this rule and the importance of owning a Sapphire card in the hobby, you want to make an educated decision on which of the Sapphire cards to apply for and then get one early into the hobby.

Cards Subject to This Rule

FAQs

Are there exceptions to this rule?

This rule only applies to the two Chase Sapphire cards, and there is no way around it. If you own one of the Sapphire cards, you must wait 48 months from when you received the signup bonus on the card to apply for EITHER card. And you must not hold a Sapphire card when you apply for a new one. You will have to cancel or downgrade before being eligible for a new one.

How do I check my status?

By loading all your cards into the Points Navigator system, we’ll keep track of your Chase Sapphire status for you. This is just one of many rules, and we’ll keep track of all other ones for you, too. The rules can get overwhelming the deeper into the hobby you get and the more cards you own. You don’t want to apply for a card that you have no chance of being approved for, so we’ll flag each one so that doesn’t ever happen.

Do business cards count for this rule?

No. The only cards this rule applies for are the two Chase Sapphire cards.

Do product changes on existing cards count for this rule?

No. Even if you downgrade your Chase Sapphire Reserve or Preferred card to a Chase Freedom Flex after 12 months, you still have to wait the full 48 months after receiving your signup bonus to be eligible for a new Chase Sapphire card. Be aware that you can downgrade from the Chase Sapphire Reserve to the Preferred after a year if you want a lower annual fee. The 48-month clock will not reset if you do this. You will still be eligible for a new Sapphire card 48 months from when you received the bonus from the Reserve card. You will have to downgrade from the Preferred before applying for a new Sapphire card though.

About Approval Rules

Collecting credit card points is largely driven by understanding and abiding by bank rules regarding approval (or disapproval) of cards. So here's what you need to know:

- Approval rules are rarely fully publicized by the banks

- We use our own research and data points from other users in creating the rules listing

- Our goal in sharing/using the rule listings is to provide you guidance to avoid getting declined

- There can sometimes be exceptions to the rules, but we try to take a more cautious approach in advising you.