Points Navigator Ranking Methodology

** Writer’s Note: The phrases you find in parenthesis (“ “) are quotes directly from our tooltips associated with each category.

One of the things that makes the Point Navigator unique is that our card rankings and recommendations are based on objective numbers and formulas -- not subjective opinions (that can be influenced by bank advertising money.) So naturally people want to understand the details behind them.

If you’re a numbers person, we think you’ll really appreciate the attention to detail. If you aren’t, you’ll just be thankful someone else is doing all this number crunching for you.

Comprehensive Value Inclusion

We set out to make the Points Navigator both user-friendly and comprehensive. In the credit card and points game, that’s an oxymoron. We felt being comprehensive was vital, however, as it’s missing from most sites, and immediately calls into question any recommendations.

To achieve this “value inclusion” synergy, we arrived at a simple test question: “Is there a use case for which we would recommend a card for inclusion?” With that in mind, we purposefully chose to omit cards, point systems and banks for which no one could make a practical use case.

The results:

- Top 100 Cards, including unique use cases for this hobby like best cash back, huge Amazon or Costco spends.

- Top 50 Point Systems, with an additional 50 shown for transfer and airline alliance purposes

- Top 10 Banks, and the approval rules that accompany them

- Top 38 Spend Categories

- Top 200 Card Extras and Benefits

If you think we missed a viable use case, feel free to shoot us an email with the scenario for potential inclusion.

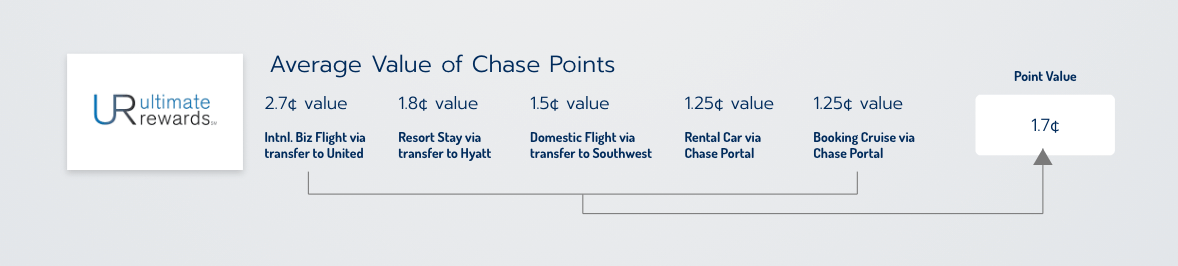

Point Value

For hotels and airlines, that process is relatively straightforward and consistent.

For transferable points, there are more variables, and valuation becomes more subjective. So we factor in additional considerations. For example, consider Citi, Chase, Amex, and Bilt Rewards. They come out to fairly similar values, though depending on the transfer partner you choose, one may edge out another. We use supply and demand as tie breakers. Citi and Bilt are harder to earn but have unique partners, which makes them slightly more valuable in our view: lower supply, higher demand. Hyatt’s high value also skews the average use case upward.

We value Bilt at 1.7 cents due to lower supply, strong transfer bonuses, and Atmos and Hyatt as anchor partners. We value Chase at 1.65 cents because of Hyatt as an anchor transfer partner. Citi is valued at 1.6 cents because it offers American Airlines and solid hotel value, combined with being harder to earn. We value Amex at 1.55 cents because the points are the easiest to earn and lack strong hotel partners. These valuations help clarify transfer recommendations when deciding which currency to use for programs like Flying Blue.

Your personal supply and demand may override these general assumptions. If you have a million Chase points but only 100,000 Amex points, you may have an oversupply of one currency, making it slightly less valuable to you. Our goal is to provide objective, math based guidance on a subjective topic.

Bonus Value

The schematic for Bonus Value is simple: “A calculation of bonus points plus the points associated with the minimum spend, multiplied by Point Value" We’ll just show our math for this one. We’ll use the Sapphire Preferred, 75,000 point bonus on a $5,000 spend. Once you have spent the $5,000, you’ll have 80,000 point. We multiply that by the 1.65 cent value for Chase points. Bonus value = $1,320.

Annual Value

What’s the actual annual value of a card? We attack that question like this: “What would you pay for those benefits if someone were to sell them to you” How do we objectively decide what is likely to be used and the valuation on these.

Cards these days come with plenty of perks, or “coupons.” We apply a likelihood of use factor to each one to estimate the annual value you can realistically expect to receive.

Want to review or adjust those calculations? Simply click on the annual value for any card to customize the valuation of each benefit based on your personal use.

Annual Fee

We display year one for “card picking” purposes, with a tooltip explaining any year-two variations. The ongoing annual fee is displayed on My Cards page, as this is more likely to be for “card cancelling” purposes

1st Year Value

Here’s how we figured our 1st Year Value:“Calculation of Bonus Value + Points from Minimum Spend + Annual Value - Annual Fee - Opportunity Cost of the Spend.” We’ll use the Sapphire Preferred, 75,000 point bonus on a $5,000 spend. Once you have spent the $5,000, you’ll have 80,000 point. We multiply that by the 1.65 cent value for Chase points. Bonus value = $1,320. Plus $109 annual value, minus $95 Annual Fee. That 5K spend could have yeilded 2% cashback, so we subtract $100. So $1320 + $109 -$95 - $100 = a 1st Year Value of $1234

This number is the basis on which the cards are ranked. Is it precisely right for every person? No. But we do feel it is the most objective way cards are ranked anywhere on the web.

It is worth noting here, that in this hobby, the card “selection” process is generally a different consideration than the process of deciding to “keep” a card going forward. This can be evaluated on our card cancellation tool, for which you’ll receive a notification and link 45 days prior to each card’s annual fee.

Personalized Values

We even endeavored to figure out your personal value for each card: “1st year value adjusted for your top priorities.” This can be found for each card on our personalized recommendations page. It’s first worth mentioning again here that if you have adjusted your annual spend categories, your “Annual Value” and “1st year value” will adjust accordingly.

Our system allows you to pick up to three priorities out of 5 categories:

- International Airfare

- Domestic US Airfare

- Hotel Stays

- Broad Coverage

- Everyday Usefulness

Based on how the rating of each reward program matches (or doesn’t match) your selections, the Annual Value is algorithmically adjusted to your personal value. As your priorities switch, this can be adjusted permanently in your Profile Settings.

Value Retained on Transfer

Here’s a simple but important calculation when you transfer points: “Value of points system being transferred from ÷ value of point destination.” Circumstances vary. For example, if you are 1,000 points short on two international flights, the value of those points in the destination system is priceless. For understanding potential options for finding good value in your point transfers, though, these numbers are a uniquely useful guide.

Working With Others For Way More Points!

Working With Others For Way More Points! How To Maximize Cards Under 5/24 Rule

How To Maximize Cards Under 5/24 Rule Will It Be A Pain To Keep Track Of Everything?

Will It Be A Pain To Keep Track Of Everything?