Chase Sapphire Reserve Credit Card Review

Key Takeaways

It’s the top of the line card for Chase and has one of the highest annual fees of any card. So is the Chase Sapphire Reserve worth it? For the first year, absolutely. The high signup bonus and $300 annual travel credit alone make the card worth $1800 minimum in the first year, which easily offsets the $795 annual fee (and that's not taking into account any of the other credits and benefits). But after that? You’re going to have to break down the variety of credits the card offers to see if it fits with your spending habits. And then combine those credits with the other perks to decide if the annual fee is worth it. If it does, then it could be a keeper for you. But the high annual fee and change into a “coupon book” style of card might price some people out of keeping this card around, both from a cost and convenience standpoint.

Why This Card Could Be Right For You

The Chase Sapphire Reserve comes with a 125,000 point signup bonus after spending $6000 in the first three months, which is a pretty low spend considering the value of the bonus.

One of the biggest benefits the Chase Sapphire Reserve offers is an annual $300 travel credit. This credit is automatically applied to any travel purchase made with the card. It does not need to be made through the portal or all at once. It can be piecemealed throughout the year for ANY travel purchase. So this essentially knocks the annual fee down to $495.

Do the rest of the benefits make you want to keep it beyond the first year? The Reserve has gone the “coupon” route that so many other rewards cards have turned to, so not only will you have to work harder to receive the necessary benefits to offset that annual fee, but you’ll have to sit down and analyze which credits you’ll even use to figure out if the card is worth keeping.

Below are the credits the Chase Sapphire Reserve offers:

- Cardholders will receive a $250 credit for select Chase Travel hotels (the stay has to be at least 2 nights) to be used any time in 2026. They only announced this as a perk for use in 2026 - it is unclear if they'll make this an ongoing credit after that.

- $300 annual travel credit (automatically applied to any travel purchase)

- Two $150 credits per year (one January - June and one July - December) for StubHub or Viagogo

- $250 in Apple TV+ and Apple Music subscriptions annually

- Two $250 credits per year for prepaid bookings with The Edit (a two night minimum stay is required each time to receive the twice per year credit). These credits can be used any time throughout the year, and you have to have two separate bookings to receive the $250 credit both times (it won't work on a single, 4 night booking)

- You can you book two, 2-night stays back to back at the same hotel, and you will receive both $250 credits in this scenario. If you book the exact same room type, you should not have to check out then back in on the third day

- There are also extra benefits that come with The Edit bookings: Free breakfast (at select properties), $100 property credit, room upgrade (if available), and early check-in/late check-out (if available)

- The extra Edit benefits are not available on the second two nights of back to back bookings in the same hotel (though the $250 credits are, provided you made two separate bookings)

- Two $150 credits per year (one January - June and one July - December) for restaurants in Chase Exclusive Tables

- Complimentary DashPass Membership (worth $120 annually), two $10 monthly credits on non-restaurant orders, and one $5 monthly credit on restaurant orders

- One $10 credit on Lyft rides per month

- $10 monthly credits on Peloton

- $120 credit every 4 years for Global Entry/TSA PreCheck

Below are additional benefits, perks, and spending multipliers:

- Priority Pass Select Membership: This is good for the cardholder and two guests

- Access to any Chase Sapphire Lounge by the Club for the cardholder and two guests

- Access to select Air Canada Maple Leaf Lounges and Air Canada Cafes

- IHG Platinum Elite Status

- Points Boost: Redeem your points for up to 2 cents per point value on select flight and hotel options through the Chase Portal and The Edit bookings

- A variety of purchase and travel protections, including auto rental coverage, roadside assistance, trip cancellation/interruption insurance, among others

- 8x points on travel booked through the Chase portal, 5x on Lyft rides, 4x on flights and hotels, 3x on dining, and 1x everywhere else

If you spend more than $75,000 on the card in a calendar year, you unlock the following benefits:

- IHG One Rewards Diamond Elite Status

- $250 credit for The Shops at Chase

- $500 Southwest Airlines Chase Travel credit

- Southwest Airlines A-List status

Note: If you owned this card before the changes were made to it on June 23, 2025, you will be able to redeem all points earned before October 26, 2025 for 1.5 cents per point through the Chase Portal. That redemption opportunity will last until October 26, 2027. After that, all points earned will only be eligible for points boost.

When The Usual Advice Doesn't Apply

- You already have Global Entry/TSA Precheck and/or Priority Pass (either through another card or paid for it yourself)

- For those who only take one trip per year or travel solo, the benefits of lounge access with guests and TSA precheck probably won’t offset the high annual fee, even with that $300 travel credit

- You don’t like having to work so hard to earn the necessary credits to offset the high annual fee

What to Know About Chase Ultimate Rewards

Chase Ultimate Rewards is our most valued point system.

- These points are the most flexible of any credit card points. You can transfer points to their partners (the most valuable way to redeem)

- Or you can book travel directly through the Chase portal, including cruise, car rental, or specialty hotels.

- The quality of their transfer partners (Hyatt, United & Southwest) is unmatched. As is the value you can get when you transfer.

- You can get a “multiplier effect” on your Chase Ultimate Rewards points when you have either of Chase’s Sapphire cards by taking advantage of Points Boost.

- We view Ultimate Rewards as the points “savings account” to top off a partner reward system for a flight or hotel. Or to book travel items directly through the Chase travel portal.

How The Chase Sapphire Reserve Credit Card Fits In The Chase Ultimate Rewards Ecosystem

The Chase Sapphire Reserve is the top of the line personal Chase card with the highest annual fee and the most perks. The Chase Sapphire Preferred is one step down, offering a $50 hotel credit (with only a $95 annual fee), 3x points on dining, and 2x points on travel, plus many of the same travel protections but without Priority Pass and a Global Entry/TSA PreCheck credit.

The Reserve is a great card if you are just getting started in the points game, especially if you know you will have multiple trips coming up the first year of owning it. With such a high annual fee, whether this is a “keep in your wallet forever card” is going to differ for each person depending on spending habits and whether or not you’ll organically use the coupon credits.

If you decide to get rid of this card after the first year, we recommend downgrading instead of canceling. With Chase's updated rules regarding Sapphire cards, you are allowed to earn the signup bonus on BOTH the Reserve and Preferred once per lifetime. So if you have never owned the Preferred, don't downgrade to it. Apply for it outright to earn the welcome offer.

Then you can downgrade to a no annual fee card like the Chase Freedom Unlimited or Chase Freedom Flex. If you downgrade to one of the Freedom cards, it is important to have a strategy for what to do with any points you haven’t transferred or cashed in, as you can only transfer to hotel partners with one of the Sapphire cards or two of Chase's business cards.

If you are doing this 2 player style, you can transfer points between spouses with the Reserve and Preferred. If you have (or are planning on getting) Chase business card(s), then it's important to know that two of them have partner transfer capabilities (Chase Sapphire Reserve Business and Chase Ink Business Preferred), and two don't (Chase Ink Business Cash and Chase Ink Business Unlimited).

It’s crucial to always have a card that transfers to partners, as that's where the highest value comes from Chase Ultimate Rewards points.

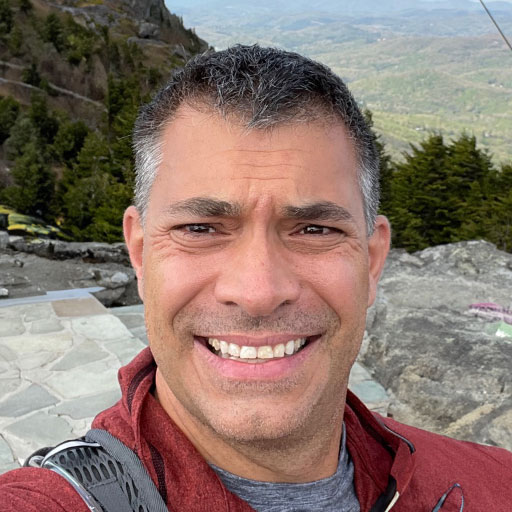

My Experience, No Filter

This was the very first card we opened when we started collecting points. The principal reason was the 1.5 redemption value we get on every point. We make some big annual spends on a couple of Chase business cards -- points that we always transfer to the Sapphire Reserve card for the 50% bonus. Factor in 3 points earned per dollar spent on dining, and you're getting back 4.5% every time you go out to eat. The $550 annual fee (less the $300 travel credit) makes the Reserve a no-brainer to keep.

Card Information

| Bonus Points | Minimum Spend | Point Value | Annual Value | Annual Fee |

1st Year Value

|

|---|---|---|---|---|---|

| 125,000 | $6,000 | 1.7 ¢ | {{ totalAnnualValue }} | $795 |

{{ firstYearValue }}

|

| Differentiating Perks | Rules |

|---|---|

| $500 Edit Hotel Credit, 4x on Flights & Hotels, 3x on Dining | Sapphire Lifetime , 5/24 , Chase 2/30 , Chase 4/6 |

Most Recent Special Offer

$4,000 spend ended Jun 2024

Card Extras

No extras to display for this card.

Card Benefits

$300 in statement credits annually for any travel purchases charged to your card. $250 in statement credits twice per year for prepaid bookings made with The Edit. Receive a separate $250 credit for select Chase Travel in 2026.

Get unlimited access to Priority Pass lounges for primary and authorized card user. You can bring 2 guests per visit. Also receive complimentary access to Chase Sapphire Lounge by The Club

Get up to $120 statement credit for Global Entry, or an $85 fee credit for TSA PreCheck.

Using this card gives you primary coverage, providing reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad.

Travel accident insurance up to $1 million; lost luggage insurance up to $3,000 per person; trip cancellation insurance up to $10,000 per person; baggage delay insurance up to $100 per day for 5 days; trip delay reimbursement up to $500 per ticket.

With 3x on Restaurants and Travel.

Visa Infinite Concierge Service: call 1-888-853-4458 to get complimentary assistance making dinner reservations, buying theater tickets, getting travel guides, sending gifts/flowers, and dozens of other specific requests.

Free roadside assistance through Cross Country Motor Club at 1-866-860-7978. Up to $50 maximum for each service event, up to 4 events each year, separated by at least 7 days.

Up to $600 per year: $300 StubHub and $300 Sapphire Reserve Exclusive Table restaurant credits. Each is split into two $150 credits, one for Jan–June and one for July–Dec. Credits expire if not used in their window.

For stays at The Edit Hotels booked with your CSR, you will receive daily breakfast for two, a $100 property credit, and a room upgrade, early check-in, and late checkout, all subject to availability

Your new purchases are covered for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

This card extends the manufacturer's warranty by 1 additional year on warranties of 3 years or less.

Spend Categories

4X points

6.6¢ Per Dollar Spent

1X points

1.7¢ Per Dollar Spent

4X points

6.6¢ Per Dollar Spent

3X points

5¢ Per Dollar Spent

8X points

13.2¢ Per Dollar Spent

5X points

8.3¢ Per Dollar Spent

10X points

16.5¢ Per Dollar Spent

Chase Sapphire Reserve Application Rules

You may be ineligible to earn a signup bonus on a Sapphire card if you received a new cardmember bonus for the same card any time in the past

Chase applications will be declined if 5 new cards have been added to your personal credit report in the past 24 months.

You'll be declined if you apply for a third Chase card of any kind within 30 days

Chase will decline your application you apply for a 5th Chase card (personal or BUSINESS) in 6 months

Best for Series

Below is a snapshot of where this card performs best compared to the other cards in our database: