Key Takeaways

Their poor points redemption value leaves Bonvoy near the bottom of our rankings.

- There are multiple cards with great point transfer options. In theory, this is good.

- Finding a solid value for a Marriott stay is a challenge. A one night stay at desirable destinations can match the number of points from one card bonus.

- Values can be found, but they can be frustrating to find, so it isn’t a terrible system. It just doesn’t have the usefulness of many of the other hotel systems.

Reward Program Ratings

Hobby Score

7.3Travel Partner Transfers

Transfers In

Transfers Out

Points Transfer Guide

How to Earn Points

The best way to earn Marriott Bonvoy points is by staying at a Marriott property or opening a co-branded credit card. Marriott is the largest hotel chain in the world, with more than 30 brands and 8,500 properties across 140 countries, so finding a place to earn points is rarely difficult. There are also six co-branded credit cards, though the maze of eligibility rules makes it harder to rely on them as a consistent source of points through signup bonuses.

Earn by staying at Marriott properties

How many points you earn depends on the brand, your elite status, and how you booked. If you book through an online travel agency, book with points, or redeem a free night certificate, you will not earn points on your stay.

If you book directly with Marriott, you will earn points based on the brand:

- 10 points per dollar at most Marriott brands

- 5 points per dollar at:

- Apartments by Marriott Bonvoy

- Four Points Flex by Sheraton

- City Express

- Element

- Homes & Villas by Marriott Bonvoy

- Protea Hotels

- Residence Inn

- Sonder by Marriott Apartments

- TownePlace Suites

- 4 points per dollar at StudioRes

- 2.5 points per dollar at Marriott Exclusive Apartments

You also receive the following elite bonuses if you hold status with Marriott:

- Silver Elite: 10% bonus

- Gold Elite: 25% bonus

- Platinum Elite: 50% bonus

- Titanium Elite: 75% bonus

- Ambassador Elite: 75% bonus

Note: Stays at StudioRes do not earn elite bonus points.

You can also earn points on eligible charges billed to your room, such as dining or spa services. Resort fees and tips do not earn points, even when they are charged to the room.

Earn by opening co-branded credit cards

Marriott has six co-branded credit cards — three from Chase and three from American Express — split between five consumer cards and one business card. There is a frustrating and complicated set of eligibility rules based on what cards you currently have, what cards you’ve previously had, and whether you’ve earned a signup bonus on certain cards in the past (even cards that no longer exist can affect your eligibility).

Each card comes with different signup bonuses, annual fees, benefits, and perks. You can earn a strong cache of points through these cards, but you need to be strategic if you want to open more than one.

Earn by opening Amex, Bilt, or Chase cards

American Express, Bilt, and Chase all transfer to Marriott at a 1:1 ratio. Because of the high cost of points stays with Marriott, we generally recommend using transferable points only for top ups. Still, transfers can be useful when you need to complete a booking.

Our Favorite Cards

Marriott Bonvoy Business

Other Cards for this Point System

Annual Bonuses & Big Spend Bonuses

- Marriott Bonvoy Boundless

- Spend requirement: Spend $35,000 each calendar year to earn Gold Elite Status the following year. You also earn 1 Elite Night Credit for every $5,000 spent.

- Our take: Poor value. You can earn complimentary Gold Elite Status simply by holding the Bonvoy Bountiful, Bonvoy Bevy, or Bonvoy Busines

- Marriott Bonvoy Bountiful

- Spend requirement: Spend $15,000 in a calendar year to receive a free night certificate worth up to 50,000 points.

- Our take: Not a good deal since the lower-fee Boundless card offers this same perk.

- Marriott Bonvoy Bevy

- Spend requirement: Spend $15,000 in a calendar year to receive a free night certificate worth up to 50,000 points.

- Our take: Same issue as the Bountiful — this perk is cheaper to earn with the Boundless card.

- Marriott Bonvoy Brilliant

- Spend requirement: Spend $60,000 in a calendar year to select an “Earned Choice Award.”

- Our take: There are some decent "Earned Choice Awards," but none justify the extremely high spend requirement.

- Marriott Bonvoy Business

- Spend requirement: Spend $60,000 in a calendar year to earn an additional free night award (up to 35,000 points).

- Our take: Very poor value. The required spend far outweighs what you get.

Other Options to Earn

Breaking Points

Special Offers Related to Marriott Bonvoy. Click the arrow to see more.

-

Feb. 13, 2023

- Hilton Honors Amex Surpass card, limited time offer of 150,000 points after spending $3000 in 6 months, $95 annual fee.

- Hilton Honors Amex Business card, limited time offer of 165,000 points after spending $5000 in 3 months, $95 annual fee.

- Hilton Honors Amex, limited time offer of 100,000 points after spending $2000 in 6 months, no annual fee.

- Marriott Bonvoy Boundless card, limited time offer of 100,000 bonus points after spending $3000 in 6 months, $95 annual fee.

-Marriott Bonvoy Bold card, limited time offer of 60,000 bonus points after spending $2000 in 6 months, no annual fee.

-

Feb. 13, 2023

- Marriott BonVoy Boundless Chase Card - Limited Time Sign up Bonus - 100,000 Points after spending $3000 in 6 months, $95/annual fee.

- Marriott BonVoy Bold Chase Card - Limited Time Sign up Bonus - 60,000 Points after spending $2000 in 6 months, $0/annual fee.

-

Sep. 22, 2022

Chase Limited Time Offer - Marriott Bonvoy Bountiful, earn 125,000 points after spending $4000 in 3 months, $250 annual fee not waived.

-

Sep. 22, 2022

Score Marriott points with this Amex card - Marriott Bonvoy Business, earn 100,000 points after spending $4000 in 3 months, $125 annual fee not waived.

How to Redeem Points

Redeem for Marriott Stays

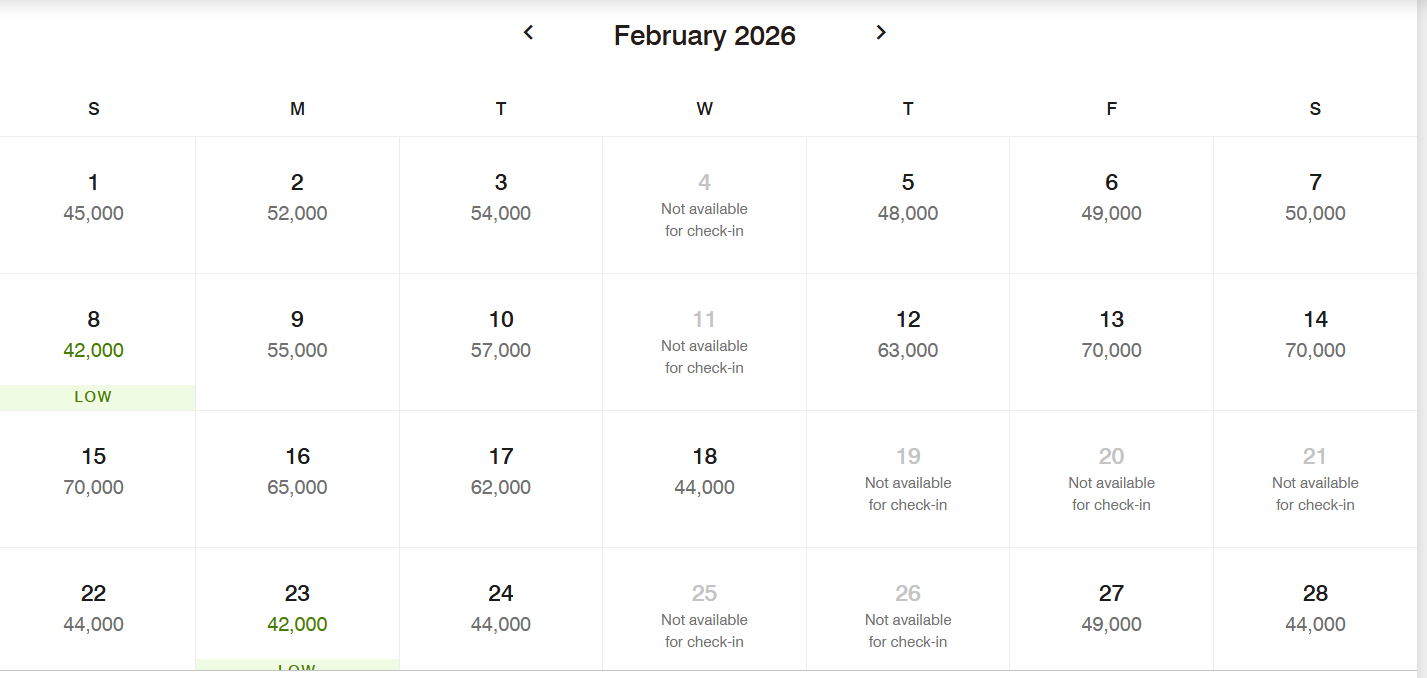

Using your Bonvoy points to stay at a Marriott property will almost always give you the best value. To search for stays using points, log in to your Bonvoy account, click “Use Points/Awards,” and enter your city and dates.

- For the lowest-cost redemptions, keep your dates and property choices flexible.

- Use the “Flexible Dates” toggle to view prices by month. Award rates can vary significantly day to day.

Airline Partners

Marriott has nearly 40 airline transfer partners, more than American Express, Citi, and Chase combined. Unfortunately, the transfer ratios are poor and rarely offer good value.

- Most partners transfer at a 3:1 ratio.

- Transfers of 60,000 points earn a 5,000-mile bonus with most airlines (effectively making it 3:1.25)

- Transfers to United earn a 10,000-mile bonus.

- No bonuses for American, Avianca, or Delta

Because of these weak ratios, we strongly recommend redeeming Bonvoy points for Marriott stays instead of transferring to airlines. Only consider a transfer for a small top off when no other options are available.

Other Options

There are a few other ways to use your points, but none are high value uses of them.

- Use Bonvoy points to book airfare or car rentals on the Air + Car self-service portal

- Use Bonvoy points to book cruises on the Cruise With Points program

Sweet Spots Finder

Discover your points' highest-value redemption options. Use the filters to find the optimal sweet spot for your next trip.

Booking Tips

These options don’t often give the best value, but when points redemptions are high, like they often are at Marriott properties, this can be a good alternative. Not only can you choose a cash+points option per night, but you can customize your stay by redeeming points for one night and cash for another, taking advantage of variable pricing throughout your stay. Unfortunately Marriott no longer allows you to do this online, so you’ll have to call if you want to make this type of reservation

Bonvoy points’ value increases quite a bit when you use your 5th night free for any booking, so try to keep those Bonvoy points for longer stays if possible.

These might not give you outsized value, but many people, especially families, prefer to rent homes for their travels. The biggest vacation rental companies don’t have points transfer partners (Airbnb/VRBO), so using your points for Marriott Homes and Villas is a great way to use rewards for home rentals over hotels

Who is it best for?

The strength of the Marriott Bonvoy program is the sheer coverage Marriott has around the world. With more than 8500 properties and 30 brands in 130+ countries, you can almost always find a Marriott—whether you want a simple, budget-friendly stay or a luxury resort. If you already have Bonvoy points, odds are good you’ll be able to use them wherever you're headed.

Marriott is best for travelers who stay with the brand often and value consistency. The more frequently you stay, the more you’ll benefit from Bonvoy, especially since redemption rates tend to be higher than other hotel chains. Perks also increase as you climb the elite status tiers, making loyalty more rewarding. Certain co-branded Marriott credit cards provide automatic status and benefits that make repeated stays even more valuable.

Status Levels Explained

Marriott Bonvoy offers five elite status tiers above basic membership, which is free to join. Basic members receive:

- Free standard Wi-Fi

- Discounted member rates

- Mobile Check-In and Mobile Key

- Points and elite night credits on paid stays

- Fifth night free on award stays

You can earn elite status by staying a certain number of nights each calendar year. Some Marriott credit cards fast-track you toward the next tier, and others provide status as a built-in perk. Paid, award, and free night certificate stays all count toward elite night credits, as long as you book directly through Marriott.

Elite Status Levels

Here are the elite status levels for Marriott Bonvoy, what it takes to reach each level, and what benefits you receive from each

- 25% bonus points on paid stays

- 2pm late checkout (based on availability)

- Welcome gift of points

- Enhanced room upgrade (based on availability)

- 50% bonus on paid stays

- 4pm guaranteed late checkout

- Welcome gift choice (points, breakfast, or amenity)

- Lounge access

- Annual choice benefit

- 75% bonus points on paid stays

- Additional annual choice benefit

- United MileagePlus Premier Silver status

- Hertz Five-Star status

- Ambassador service

- Your24: Choose your check-in time and keep your room until the same time on the day of departure

- Hertz President’s Circle status

What to Know Before Canceling

Before opening a Marriott Bonvoy credit card, it’s crucial to understand the maze of rules, especially if you plan to earn signup bonuses from multiple cards. When you’re ready to cancel a card, make sure you know which cards you are and aren’t eligible for next, as well as any welcome offers you may or may not qualify for.

Fortunately, any points you earn from a Marriott Bonvoy card are safe for at least 24 months. Any earning or spending activity will reset the clock, but gifting or transferring points, as either the sender or the recipient, does not count as qualifying activity

FAQs

- Does it cost money to be a Marriott Bonvoy member?

- It does not cost anything to join Marriott Bonvoy. You simply sign up. Members receive perks like free WiFi on Marriott stays, access to member rates, mobile check-in, and the ability to use your phone as your room key.

- How to get a free night at a Marriott hotel?

- There are several ways to get a free Marriott night. You can earn points from co-branded cards and redeem them, transfer points from Amex, Bilt, or Chase, or hold a Marriott card that offers free night certificates as part of its annual benefits.

- Can I book a room for someone else with my Marriott points?

- You can, but you must call to book the room. Marriott calls this a Gifted Award Redemption. The guest will need to show ID and provide a credit card for incidentals at check-in. Neither you nor the guest will earn points or elite night credits for the stay.

- Can I use my Marriott Bonvoy points for flights?

- Yes. Marriott partners with nearly 40 airlines, so you can transfer points to book flights. Transfer rates are poor, though, making it a bad value. It’s best used only to top up an airline balance rather than covering an entire redemption.